This sort of financing is usually a revolving line of credit score similar to a HELOC – apart from your house isn’t necessary for collateral. Even though a personal line of credit history capabilities similar to a bank card, it ordinarily provides bigger credit history restrictions and much more favorable annual share prices.

We can also hook up you with neighborhood contractors and lenders inside our intensive network so that you can be confident you’re getting the greatest high quality for the lowest premiums.

It’s widespread for family members to outgrow their homes and residing House. Whether more little ones are additional for the family, or There is certainly the addition of a pet or two, we can count on the demand from customers for dwelling Area to increase eventually.

With more than twenty years within the company, we’ve found and done it all. Down load our FREE GUIDE to restoring your period of time home right now.

“ For people today like us which has a hectic timetable trouble-free service on the internet with out going to the bank was really a lifesaver.

1. Home fairness loan A home equity loan (HEL) helps you to borrow towards the fairness you’ve built up in the home. Your equity is calculated by evaluating your home’s benefit and subtracting the exceptional equilibrium because of in your existing home finance loan loan.

Lots of home advancement ต่อเติมบ้าน แยกโครงสร้าง loan lenders cost expenses, which include origination service fees and prepayment penalties, which can increase to the entire cost in the loan, so homeowners will need to make an effort to comprehend their predicted costs in advance of committing to this way of financing.

Of course, a greater curiosity charge indicates larger month-to-month payments and it’s really worth noting that these can generally be someplace involving 8% and fifteen%. On bank cards, this will often be even greater.

There might be some laid bearing partitions you just can’t clear away or spots without plumbing or electrical that will require a lot more specialty subcontractors to finish.

Regardless of whether it’s to accommodate your escalating family members or adapt for your transforming desires, an addition can supply an incredible ROI equally fiscally and functionally.

Phase 6: In case you don’t have home equity to borrow from, take a look at a home enhancement loan or a personal loan to finance the venture.

When land is at a premium, a next-Tale addition might help homeowners significantly improve their living space without increasing the property’s footprint. These additions frequently double the amount of floor space (Except merely a partial addition), and might drastically strengthen a home’s resale value.

Envy Abode creates seamless home extensions that Mix with the prevailing construction, employing wise technological know-how and modern design to improve functionality and aesthetics, guaranteeing a cohesive and contemporary residing Room.

Under is a list of the varied financing solutions offered and The main features of every.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Alisan Porter Then & Now!

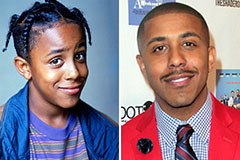

Alisan Porter Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now!